Although the S&P 500 index returned 10%, on average, since 1926, the actual return in each year was 10% +/- 2% in only six of the past 93 calendar years. In most years, the index’s return was outside of the range—often above or below by a wide margin—with no obvious pattern.

Being aware of the range of potential outcomes can help investors remain disciplined, which in the long term can increase the odds of a successful investment experience.

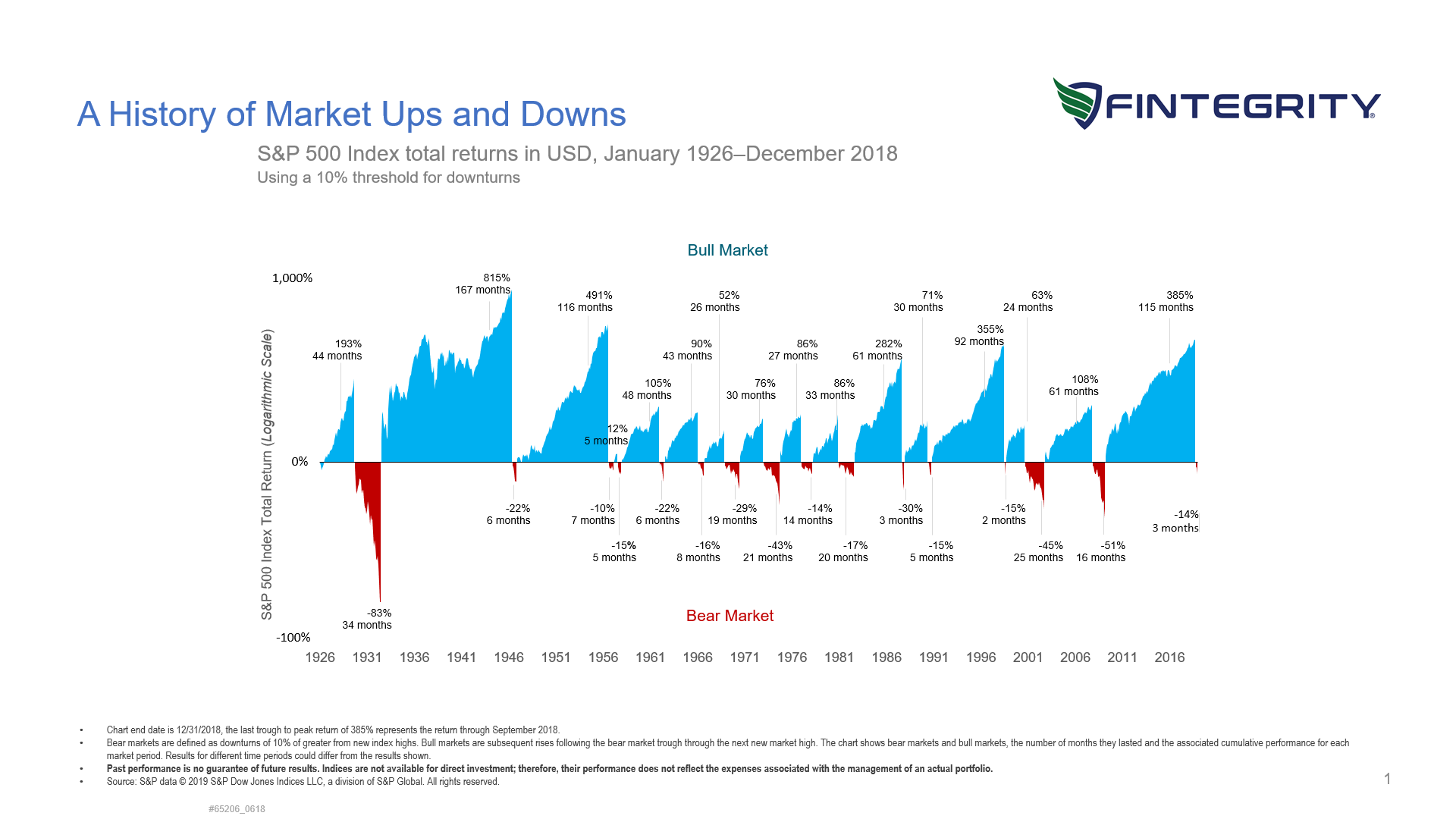

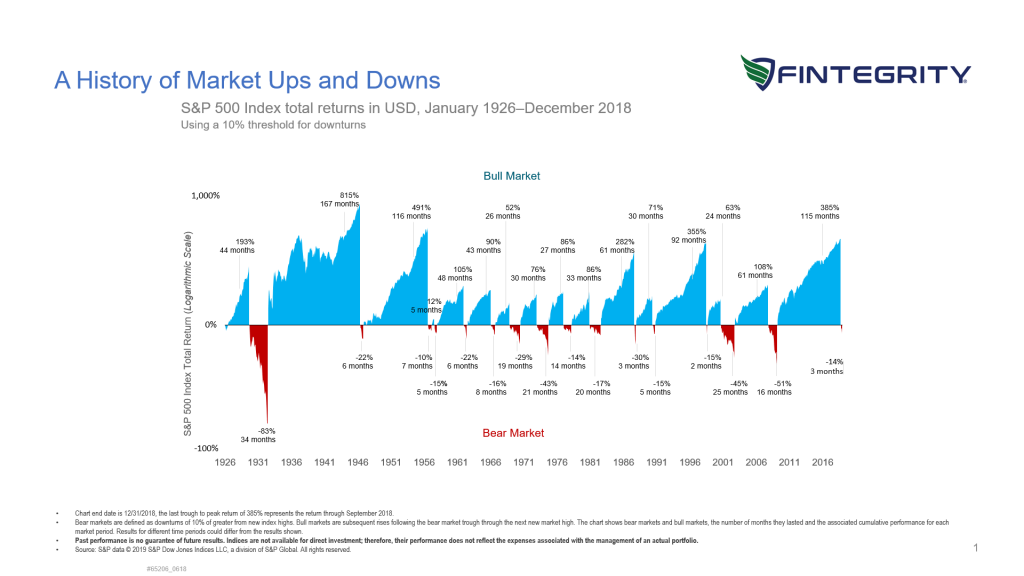

Furthermore, the following chart on the History of the S&P 500 index helps provide context regarding stock market movement. As shown, good times have been disproportionately longer than the bad times and the bull run duration is not a useful indicator of future performance. Investors staying the course have been rewarded over the long term.

For professional management of your investment portfolio contact Jeffrey Barnett. jb@fintegrity.biz | 201-266-6829 | www.fintegrity.biz.

0 Comments