Bank Industry Turmoil

This article describes the primary reasons for the current banking industry turmoil, where things may go from here, and how to safeguard your cash.

2023 Bank Failures

· Silicon Valley Bank (SVB) in CA

· Signature Bank in NY

· Silvergate Bank in CA

Why Banks Failed

- Banks invested too much of their deposits in long-term bonds while interest rates were low to earn a bit more interest income.

- The Fed raised interest rates faster and higher than many bank management teams expected, producing large losses on banks’ long-term bonds.

- When SVB attempted to raise capital, customers lost confidence in SVB and other banks’ stability.

- Bank customers withdrew their money to:

a. support their businesses as funding became scarce (especially for venture capital),

b. earn higher interest rates elsewhere, and

c. seek safety for uninsured deposits. - Banks were unable to repay depositors while maintaining adequate capital, causing them to fail.

From 2020 through 2021, Silicon Valley Bank took in incredibly large amounts of deposits from clients who were taking their companies public. SVB invested much of those deposits in long-term bonds, such as mortgages and treasuries, while interest rates were low.

2022 was a very different year. Not only did Silicon Valley Bank’s unique customers of private companies start to need cash and, as a result, pull their deposits, but interest rates also increased. The result negatively impacted the mark-to-market value of their longer-term bonds. In an effort to appropriately deal with the impact of mark-to-market losses, the bank used a permitted accounting change to consider those bonds “held to maturity.”

Banks can hold assets as “available for sale,” which means they are valued using market prices. Another option is to call them “held to maturity,” meaning they won’t be sold. These bonds are held at the banks’ cost. The logic is that daily market prices aren’t relevant to assets that banks wouldn’t sell.

The combination of growing withdrawals and holding too few assets that were available for sale forced the bank to sell their held-to-maturity bonds. When they sold these assets, the paper losses became realized, and those losses overwhelmed the bank’s equity, causing the bank to fail.

All of this happened over the course of a week—and mostly over a two-day period. SVB’s stock was worth $267.83 at close of business Wednesday, March 8 and worthless, according to regulators, by the close of business Friday, March 10.

Signature Bank in New York faced a similar problem, as SVB’s collapse prompted many of Signature Bank’s customers to withdraw deposits due to a similar concern over liquidity risk. Approximately 90% of Signature’s deposits were uninsured by the FDIC because account balances exceeded FDIC insurance limits.

Making matters worse for Signature Bank, which specialized in serving the cryptocurrency industry, is that crypto prices slumped last year and Sam Bankman-Fried’s FTX (cryptocurrency exchange) imploded. Signature Bank’s digital-asset clients represented more than a fifth of its deposits, which added to the rapid deposit withdrawal of its clients. On March 12, 2023, Signature Bank was closed by the New York State Department of Financial Services and the Federal Deposit Insurance Corporation (FDIC) was named Receiver.

Did Silicon Valley Bank do anything wrong? SVB did not adequately hedge their interest rate risk. Poor risk management ultimately spelled their doom. It would have been easy to reduce purchases of long-term bonds in 2021, but the appeal of making a bit more money on their deposits prompted them to make what turned out to be the wrong decision. Also, many market participants did not expect the Federal Reserve to raise interest rates so much so quickly. They were unprepared for the shifting market environment.

Some have said it was a “bank run.” Is that right? Yes, there are three reasons why depositors withdrew their money.

- Many depositors needed money because their startup businesses were not as successful as anticipated, due to the market environment.

- Some depositors wanted higher interest rates that could be achieved with a money market fund (4.5% vs. 1% at many banks).

- When depositors realized that the bank’s tangible equity was falling, those with more than the FDIC-insured limit of $250,000 on deposit decided to take their additional savings out to be safe.

Is the risk the same for “big banks” (over $250B in assets)? No. Large banks are better positioned to hedge their interest rate risk and have more diversified clientele. As a result, they are less prone to the same degree of risks as Silicon Valley Bank and Signature Bank. However, risks remain.

What about smaller banks? Some smaller banks with more aggressive treasury operations (what they choose to do with the deposits and how they hedge or not) are at risk. Several other midsize banks (with less than $250 billion in assets) have large unrealized losses that can reduce their tangible equity to low amounts, if they are forced to sell their long-dated “held to maturity” bonds.

We discuss bank size partly because after the Financial Crisis of 2008, banks that were “too big to fail” or systemically important financial institutions were given higher capital requirements and closer regulatory supervision. However, associated stress tests focused on the potential for bad loans in adverse economic scenarios. There was no focus on the potential loss of deposits. In this way, regulators were fighting the last war.

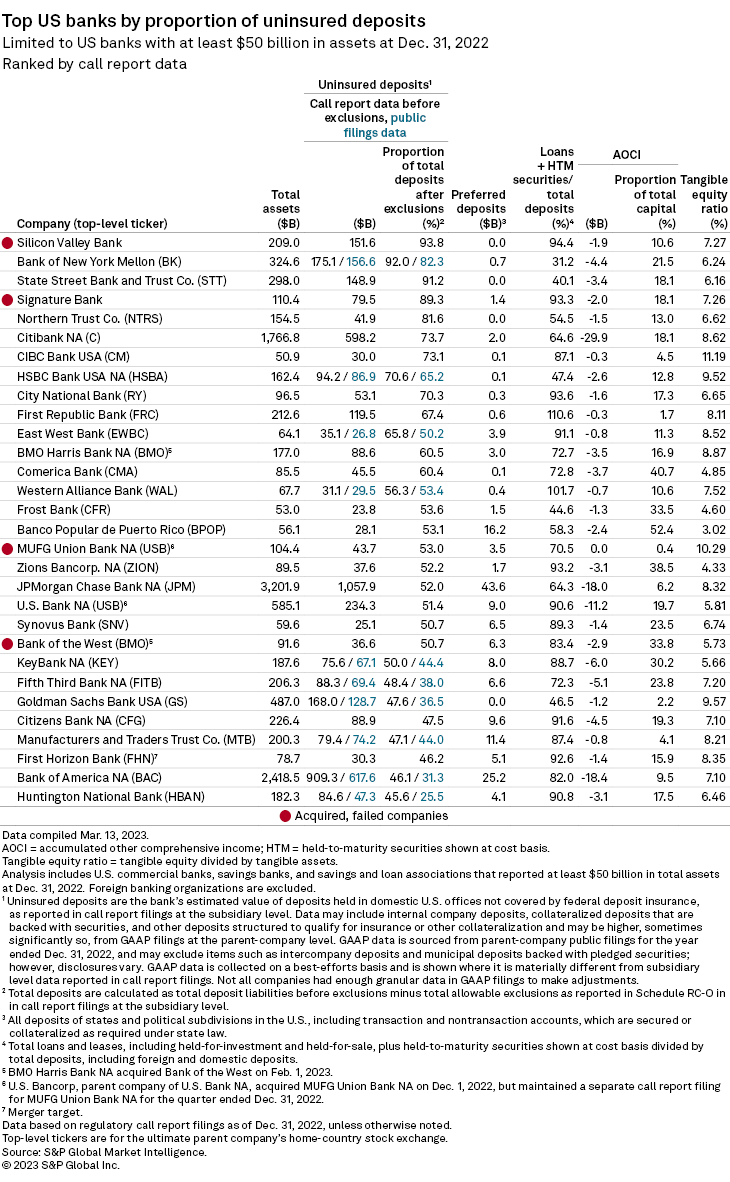

For perspective on the above chart, banks generally want to maintain a common equity Tier 1 capital ratio of at least 7% or face fines from regulators. Banks that go below 4.5% could trigger a takeover by regulators.

It’s important to remember that unrecognized losses will not have to be recognized on financial statements unless there is a run on bank deposits that exceeds each bank’s liquid resources, including their ability to tap the new Fed BTFP lending program, explained in the next paragraph. In other words, regulators focus on the blue dots. The red dots represent a worst case scenario in which bond holdings are sold and losses are recognized.

Regulatory Response

The Federal Reserve implemented a new Bank Term Funding Program (BTFP) that enables banks to borrow for one year against their bonds that lost value as if no loss occurred.

This will help prevent banks from prematurely selling depreciated bonds to meet client withdrawals, thereby saving banks from recognizing losses on their financial statements that could force them to raise capital. Once SVB attempted to raise capital, consumer confidence was lost and the bank quickly failed.

Because uninsured deposits range between 25% and 91% of assets at banks shown in the table below, I strongly believe that FDIC insurance limits should be raised to cover all deposits. Doing so would eliminate the safety concern for deposit flight, but not the incentive to earn higher interest rates.

It takes an act of Congress to increase FDIC insurance coverage and there may be political concern about appearing to “protect the rich” by extending insurance to larger balances. In addition, there is the issue of paying for more insurance coverage from an FDIC insurance fund that was already reduced by more than $20 billion from recent bank failures. Nevertheless, if a broad-based bank scare unfolds, I fully expect FDIC insurance to be quickly extended, as it was for SVB and Signature Bank customers.

Some argue having unlimited deposit insurance encourages risky behavior, but capital markets would continue providing a strong incentive against such “moral hazard”.

Where Do We Go From Here?

I see two primary scenarios:

- The Bank Scare is Over – In this scenario, depositors are satisfied that the Fed, FDIC, and other regulators will do what is necessary to keep deposits safe, preventing them from pulling uninsured deposits from their banks. Historically, depositors have been slow to move deposits for the sake of higher yields and that behavior continues. Bank stocks have already declined to reflect the headwinds banks are facing and will recover as the Fed pivots from raising interest rates to lowering them (which is what Wall Street expects and would be needed if the economy enters a recession). When interest rates decline, unrealized losses on long-term bonds on bank balance sheets would be reduced. Although the Fed describes its “dual mandate” as controlling inflation and pursuing full employment, protecting the banking system comes ahead of everything else. As a result, the Fed will do what is necessary to help prevent dysfunction in the banking industry. Distressed stock values can be opportunities in the long run.

- More Banks Fail – The lack of explicit deposit insurance on balances above $250,000 per owner by account type combined with the incentive to earn higher interest rates elsewhere causes banks to continue bleeding deposits until more rescues are required. Online banking, which reached higher penetration during Covid lockdowns, has made moving deposit balances easier than in the past, encouraging balance transfers. When Moody’s downgraded the credit-rating outlook of the U.S. banking system on March 17, it too cited the threat to many lenders’ deposits: “Banks with substantial unrealized securities losses and with non-retail and uninsured US depositors may…be more sensitive to depositor competition or ultimate flight, with adverse effects on funding, liquidity, earnings and capital.” High interest rates will add to these pressures until inflation returns to the Fed’s 2% target. The breathtaking speed of SVB’s failure leaves little time to recalibrate once news breaks that a bank is in distress and more banks fail. The most likely candidate to fail next is First Republic Bank.

Although inertia is a powerful force in favor of scenario one, I expect fear and greed will motivate enough people to move their money, triggering more problems for the banking industry.

An additional challenge on the horizon for commercial banks is refinancing maturing commercial real estate loans on office properties with high vacancy rates. Lower rental income from these properties, higher interest rates, and lower property valuations are expected to increase loan defaults, further pressuring bank profitability and capital.

Protect Your Uninsured Bank Deposits

If you have deposits that exceed FDIC insurance in a bank, move those balances to obtain FDIC coverage or to a US Treasury money market fund.

- FDIC Insurance Up To $50 Million – Some banks participate in a program called IntraFi Cash Service (ICS) and Certificate of Deposit Account Registry Service (CDARS). These programs allow depositors with large amounts of money to access FDIC insurance coverage for amounts beyond the standard limit of $250,000 per depositor, per bank, per ownership category through a single participating bank. This is achieved by spreading deposits across multiple banks within the ICS and CDARS network. This way, customers can have up to $50 million in FDIC-insured deposits. You must request this service, it is not automatically provided. To find banks that offer this enhanced FDIC coverage, you can visit the IntraFi website (https://www.

intrafinetworkdeposits.com/) for a list of participating institutions. Keep in mind that banks can join or leave the network at any time. With banks desperate for deposits, several of them are paying high rates on new money, such as Maryland-based CFG Bank, which is currently paying 5.15% on their 12-month CD and 5.02% on liquid high yield savings accounts. CFG is currently listed as a participating ICS bank, but the available interest rate may vary when participating in the ICS program, so ask about that before opening an account. - US Treasury Money Market Funds – US Treasury money market funds contain Treasury bills that are 100% backed by the Federal government and have almost no interest rate risk because the weighted average maturity of bonds in the fund must be 60 days or fewer. The 7-day SEC yield on Fidelity’s Treasury Market (FZFXX) fund was 4.46% as of March 31, 2023. Vanguard’s US Treasury Money Market Fund (VUSXX) had a 7-day SEC yield of 4.70% as of the same date, but Fidelity has far better customer service that I believe is worth the difference in yield. Fidelity offers business accounts, so this applies to both business and personal deposits. Just be wary of additional products that Fidelity and other brokerage firms may attempt to sell you because many of their representatives are paid bonuses to push higher priced products that earn the firm more money, even if those products are not better for you.

If you have questions about this article or your investment portfolio, call Jeff at 201-266-6829.

0 Comments