For long-term investors, understanding what can and cannot be controlled is crucial for financial success and peace of mind. While every investor may want to predict market movements, experience teaches us that it’s a challenging task.

Optimal Approach

The optimal approach often involves constructing and managing a suitable portfolio, making strategic and tactical allocations based on market opportunities, ideally with assistance from a trusted advisor. Success is more likely by saving early, staying invested, and remaining focused on long-term financial goals.

Maintaining financial discipline is more important than ever, given the surge of information from media and the financial services industry. Headlines seem to jump from one concern to the next every week, causing markets to swing between exuberance and distress, as witnessed throughout this year.

History

The truth is, this is not a new phenomenon. In 1979, for instance, BusinessWeek famously declared “the death of equities” due to inflation – a sentiment echoed by many last year. In the short term, these assessments seemed correct, as markets retraced due to economic shocks and recessions. Yet, both the market and the economy ultimately recovered.

Not only has the market achieved strong returns this year, despite recent volatility, but the past 40 years since that magazine cover was published have been some of the most fruitful in history.

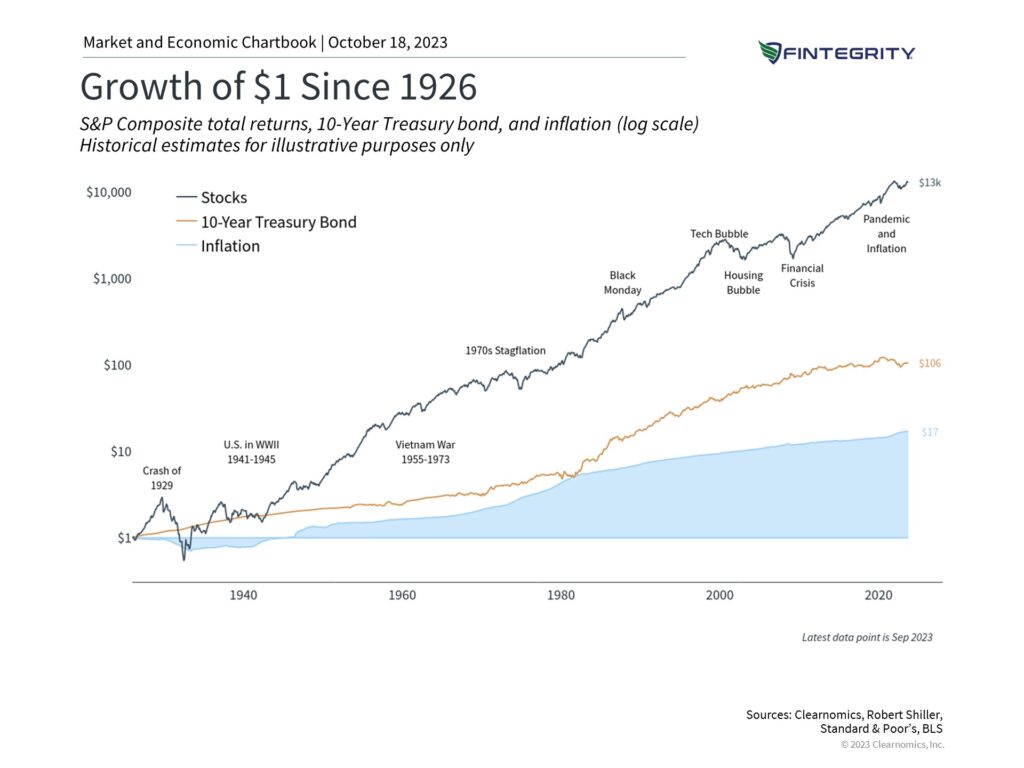

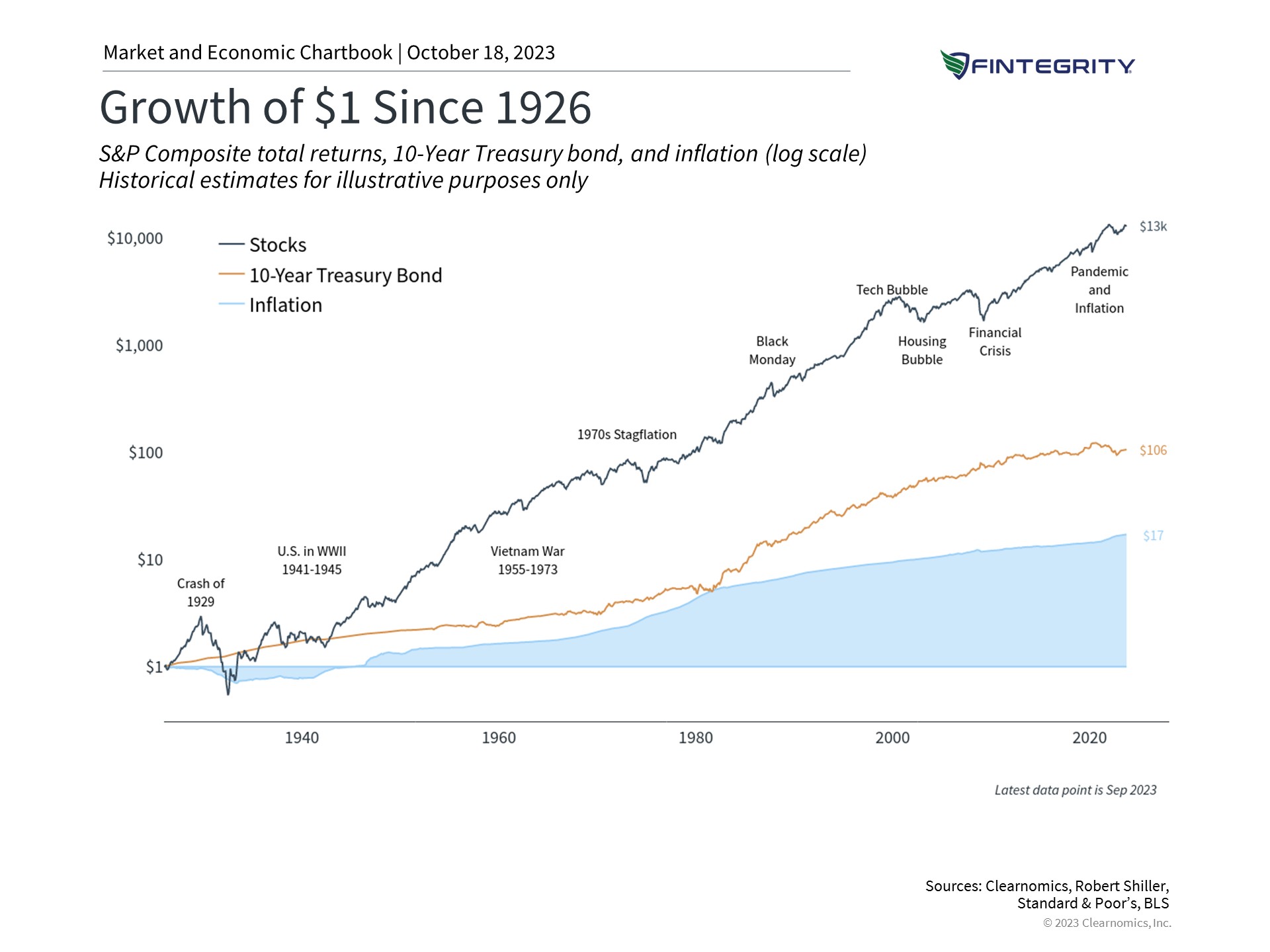

This pattern holds when we look further back in time: the accompanying chart illustrates the growth of $1 invested in stocks and government bonds since 1926. Astonishingly, a $1 investment in stocks nearly a hundred years ago would have soared to over $13,000 today, despite the challenges faced along the way. Even a risk-free investment in government bonds would have grown to $98. In comparison, inflation has led to the erosion of cash’s purchasing power, with $17 now required for what used to cost $1.

The following chart demonstrates the significant wealth generated by the stock market for patient investors. However, bonds are also necessary to mitigate volatility. (Please note this chart uses a “logarithmic scale” to compare stocks, bonds, and inflation. If presented on a linear scale, the steepness of the stock market line would be even more remarkable.)

Timing

Equally important is the timing of saving and investment. For instance, a starting investment of $1,000, compounding annually at 7%, could potentially grow to over $10,000 by age 65 if invested at the age of 30. If the same investment is made at age 35, just five years later, it would only reach approximately $7,600.

Conclusion

Invest early and remain committed, even during challenging times. History shows this is the most effective strategy for realizing long-term financial objectives.

Risk Disclosure: Investing involves risk, including the potential loss of principal. Past performance does not guarantee future results.

0 Comments