Making the Retirement Decision Easier

Are you thinking about retirement? It’s a major decision. An accountant I know said he and his wife think they have enough to retire, but want to be 100% sure before they stop working. He tried several online financial calculators, but correctly recognized that they...

Are You Prepared for Rising Estate Taxes?

Current Estate Tax Current tax law provides an exemption of $11.7 million per person ($23.4 million for a married couple) in 2021 to be passed to beneficiaries without federal estate tax. The federal estate tax rate is currently 40%. Proposed Changes President Biden...

Gamestop Stock Rise and Controversy Explained

Gamestop investments will end in tears for many folks caught up in it.

Investing for Inflation

US Dollar After Inflation The US Federal Government’s massive $5.6 trillion expansionary policies through July 31, 2020 mitigated much of the short-term economic damage from the government-mandated shut-down, but is causing many investors to worry about impending...

3 Steps to Know When You Are Financially Ready to Retire

Determine the Resources You Will Need to Sustain Your Living Expenses Once You Stop Working A common question people ask is “Do I have enough money to retire?” The answer depends on several factors. This 3-Step guide will help you determine the resources you will need...

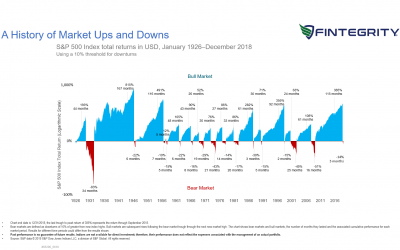

Stock Market Returns Averaged 10% Since 1926

Although the S&P 500 index returned 10%, on average, since 1926, the actual return in each year was 10% +/- 2% in only six of the past 93 calendar years. In most years, the index’s return was outside of the range—often above or below by a wide margin—with no...

Estate Planning Tips for Couples and Surviving Spouses

These excellent estate planning tips for couples and surviving spouses appeared in the March 30, 2019 edition of the Wall Street Journal. I'm posting the key tips and a link to the article for easy reference. Take key steps for advance planning: ☑️ Hire an estate...

How Much Should Be Invested in Stocks?

Stocks Power Portfolio Values Over Long Periods There are 3 major factors to consider when contemplating your asset allocation: timing, risk tolerance, and to a lesser extent, valuation. This question is on people's minds no matter what the stock market is doing. I...

How Long Should You Plan to Live in Retirement?

One of the major inputs for retirement planning is how long you expect to live. Retirement calculators ask you to forecast your lifespan or number of years living in retirement. It’s a necessary input because longevity informs the estimated number of years your...

Fintegrity’s Investing Philosophy

Fintegrity’s investing philosophy is grounded in behavioral finance, understanding that emotion and psychology play a role when investors make decisions, sometimes causing them to behave in unpredictable or irrational ways that create opportunities and deviations from...